Ant Financial’s IPO was canceled, causing Alibaba’s share price to fall,

Alibaba has been unfavorable this year. First, the cancellation of Ant Financial's IPO indirectly caused Alibaba's stock price to fall, and now there is an antitrust investigation led by Alibaba, which caused Alibaba's stock price to plummet by 15% in a single day. From the highest point in October, the stock price of 319 dollars has fallen by as much as 30% to 222 dollars.

From the perspective of K-line, Alibaba has reached the Oversold area, and it will rebound upward in the short term. From the perspective of valuation, Alibaba’s valuation is as high as US$388, which is 74% of the current share price of US$222. Value-added space, so it seems that whether it is viewed from the short-term K-line or the long-term valuation, now is a good time to buy the bottom of Alibaba.

Before investing, I will analyze and analyze the root cause of the disadvantage of Alibaba this time, because if this problem is not resolved, Alibaba’s stock price will always face huge political risks, so have you ever thought about whether Alibaba is a poke Which sensitive nerve has found these murderous opportunities from the top?

Is it because of Jack Ma's speech? But Jack Ma’s speeches have always been bold, or are Alibaba and Ant Financial too big? The risk is too high? Then why is Tencent involved? Tencent’s stock price has also fallen 15% from its highest point.

All this is to blame on Alibaba’s Alipay and Tencent’s WeChat payment, which blocked a big plan of the central bank, which is the implementation of the central bank’s digital currency.

Here to express my personal opinion, but the timing of all anti-monopoly is very delicate. All this is due to Alipay of Alibaba and WeChat payment of Tencent, which blocked a big plan of the central bank, which is the implementation of central bank digital currency. This is not entirely my alarmist talk. It is clearly stated in the prospectus of Ant Financial's IPO: "Our business model may be negatively affected by some new payment models implemented in China."

Among them, there are mentions of the electronic digital currency invented by the central bank, and the impact of the implementation of electronic money on consumer payment habits, and how the central bank's digital currency will integrate into the existing electronic payment industry. All uncertainties, this central bank’s digital currency,

Simply put, it is the cash issued by the central bank, but it is used in the form of an electronic wallet and may be used as a substitute for coins and cash notes in the future.

Many people may find it strange that we are already using electronic payment methods such as Alipay and WeChat Pay. What is the difference between this and the newly launched central bank digital currency? The difference is that Alipay and WeChat Pay need to bind a bank card first, and then use a QR code and other quick payment methods, but they are a disguised card consumption.

But the central bank's digital currency is different. It is real gold and silver issued by the central bank. If a digital currency of 1 yuan is issued, there is 1 more currency in the market, which can directly affect the total amount of currency in the market. Currency is currency, and Alipay and WeChat Pay are third-party payment platforms, and will not affect the issuance of digital currency, but the monopoly of Alibaba and Tencent does hinder the issuance of digital currency from the following aspects, which also attracts With these kinds of political risks,

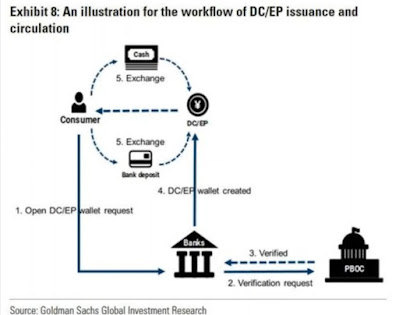

Let's first look at how the central bank's digital currency is implemented. The central bank is the largest boss that controls the issuance of digital currency, but the central bank has no way to directly send money to people because the central bank does not know who to send it to, so this digital currency needs the central bank First distribute the digital currency to the middleman, and then issue it to the electronic currency wallet through the middleman. These middlemen are traditionally several major banks in China, such as Industrial and Commercial Bank of China, Construction Bank, Bank of China, and Agriculture Banks, etc.,

These banks have successively launched trial versions of e-currency wallet apps, preparing to respond to the promotion of digital currencies, but this set of e-wallet apps has huge opponents. The current cashless retail payments, Alipay and WeChat payment have already occupied more than 90% of the market share, so to promote the central bank’s digital currency, it is necessary to add Tencent and Alibaba to similar intermediaries connecting several major banks.

But putting the issuance of digital currency in the hands of two major private companies requires the government to plan those rules and regulations to ensure that Alibaba and Tencent follow the same rules as traditional banks. A series of reforms, including such as returning to the service platform that focuses on providing payment, correction, or "exit" of lending, insurance, financial management, etc.

The monopoly of Alibaba and Tencent's electronic payment also has another problem. So far, these large e-commerce companies are operating in a closed environment, such as JD.com, which does not accept Alipay. , And WeChat Pay is not supported on Alibaba’s platform. Similarly, Meituan, which is backed by Tencent, also does not support the payment method of rival Alipay.

And such a monopolistic operation model is likely to be banned in this anti-monopoly investigation because the central bank’s digital currency is a cash currency, not a payment platform, so it cannot be rejected by any platform, just like Yes, can you imagine the situation of shopping in the mall with RMB cash, and the result is rejected by the mall?

But even if all of these are resolved, it is still not enough. Due to the monopoly of Alibaba and Tencent in electronic payment, even if the corresponding management laws are introduced, the central bank cannot rest assured to rely on the two private companies as the main digital currency. Instead, issuers would prefer to allocate this role more to the digital currency wallets of traditional banks.

Therefore, it can be expected that shortly, the central bank will encourage everyone to use the digital wallets of traditional banks, and even the digital wallets issued by the central bank itself, to weaken the people's dependence on Alipay and WeChat payment, but it is not so necessary to achieve this. simple,

The reason why Alipay and WeChat Pay are so popular is that they are connected to many other apps in the application software. For example, through Alipay and WeChat App, you can directly call uber, book movie tickets, book air tickets, and hotels, and monopolistic cross-selling is likely to be the focus of this monopoly investigation, which will weaken the cross-selling revenue of the two major groups.

In general, it is conceivable that after the introduction of the central bank's electronic currency, the implementation of traditional bank digital wallets is likely to weaken the market share of Alibaba and Tencent in electronic payment. Take Ant Financial as an example. It has opened up to financial services such as insurance, financial management, lending, etc., but these three pieces are likely to be peeled off this time, and the biggest remaining one is electronic payment.

As far as Ant Financial is concerned, it has handled a full 17 trillion electronic payments in the past 12 months, but this one is likely to be greatly weakened. In addition to losing more, it is a major issue for electronic payments. The control of data, the central bank’s electronic money, is to reduce the use of cash, to reduce money laundering, crime, etc.

But the ultimate goal, everyone knows, the ultimate goal of any central bank's digital currency in the world is to be able to thoroughly track the direction of funds.

These big data were previously owned by Tencent and Alibaba, but after the central bank's data currency wallet is launched, the big data behind this will be controlled by the central bank. Before the launch of the data currency, those delayed economic statements, the central bank's data currency The tracking of the government will bring real-time data analysis to the government, which industry needs macro-control, which industry has insufficient consumer power and needs stimulation, etc.

Then Tencent and Alibaba have lost a lot of the commercial value that these data could bring. In this way, if the starting point of this anti-monopoly investigation on Tencent and Alibaba is indeed triggered by the central bank’s digital currency, as expected, Then the impact may not be like many friends hope, walk away from the form, the thunder is heavy and the rain is small, but the actual transformation is peeling.

In this way, short-term K-line analysis, or long-term valuation analysis, may have to step aside. The risk of political factors will greatly affect technical analysis and the company’s fundamentals.

How will Tencent and Alibaba coexist with the central bank's digital currency? This will be a key factor in Alibaba and Tencent's share price forecasts.

Comments

Post a Comment